Tax reform’s new rule that employers can no longer deduct parking expenses for employees impacts both tax-paying and tax-exempt organizations — and represents a big change for everyone. Accordingly, the IRS recently released interim guidance in Notice 2018-99, aimed at helping employers determine the amount of parking expenses that should be treated as Qualified Transportation Fringe Benefits and are therefore nondeductible.

However, the guidance is especially critical for not-for-profit organizations to take note. Tax-exempt organizations that historically have not had unrelated business taxable income (UBTI) may be surprised to learn their “new” parking expenses qualify as such and could lead to tax obligations.

If you are a tax-exempt organization, it’s important that you identify what types of parking expenses you have and complete the four-step calculation provided in the Notice. The calculation will allow you to determine the amount of parking expense that will be considered UBTI, so you can plan ahead for any potential new tax liabilities. Below is an example that illustrates the four-step process.

>> Read an overview of the new parking rules in “An Employer’s Guide to Parking Benefits Under the TCJA.”

The Four-Step Process

Below are the facts related to a tax-exempt religious organization that operates a church and a school:

- Owns a surface parking lot adjacent to its buildings

- Incurs $10,000 of total parking expenses

- For Notice 2018-99, “total parking expenses” include, but are not limited to, repairs, maintenance, utility costs, insurance, property taxes, interest, snow and ice removal, leaf removal, trash removal, cleaning, landscape costs, parking lot attendant expenses, security, and rent or lease payments or a portion of a rent or lease payment (if not broken out separately). A deduction for an allowance for depreciation on a parking structure owned by a taxpayer and used for parking by the taxpayer's employees is an allowance for the exhaustion, wear and tear, and obsolescence of property, and not a parking expense for purposes of this notice.

- Parking lot has 500 spots used by its congregants, students, visitors and employees; 10 spots are reserved for certain employees

- During the normal hours of activity on weekdays, generally has approximately 50 employees parking in the lot in non-reserved spots and approximately 440 non-reserved parking spots that are empty

- During the normal hours of activity on weekends, generally has approximately 400 congregants parking in the lot in non-reserved spots and 20 employees parking in the lot in non-reserved spots

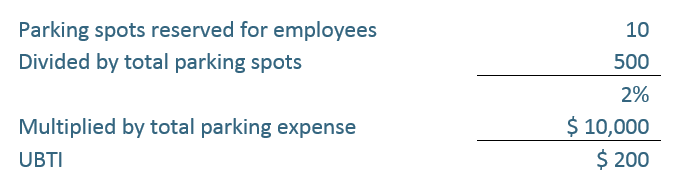

Step 1: Calculate number of parking spots reserved for employees to determine if UBTI has been generated.

Take the number of total spots reserved for employees and divide by the total spots. Multiply that answer by the total parking expenses. This is the amount that is nondeductible and will be included in UBTI for a tax-exempt entity. Employers may, until March 31, 2019, eliminate reserved spots for employees and avoid counting such spots retroactively to January 1, 2018.

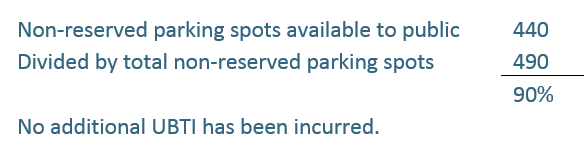

Step 2: Determine primary usage for the remaining spots to identify if additional UBTI has been incurred.

This is tested during normal business hours of the employer. An employer may use any reasonable method, including actual or estimated usage, number of employees, etc. in making the determination. If the primary usage (more than 50%) is for the general public, then no additional amount is disallowed or included in UBTI for the entity. Usage is considered for the general public if it is used by customers, clients, patients, visitors, students, delivery vendors, etc., but not employees, partners or independent contractors. Empty spots are considered general public usage.

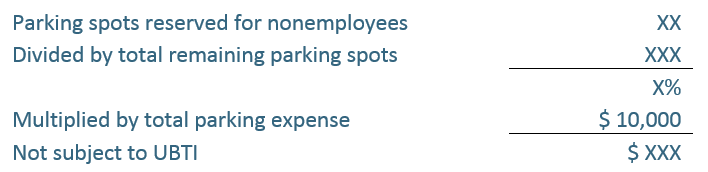

Step 3: Calculate reserved nonemployee spots.

If less than 50% is used by the general public, then you must calculate an amount for reserved nonemployee spots. Reserved nonemployee spots include those reserved for visitors and customers. That amount is calculated using the formula below and is not subject to UBTI for tax-exempt entities.

Step 4: Calculate amount to be included in UBIT income.

If less than 50% is used by the general public, then the amount to be included in UBTI for the remaining unreserved parking spots is determined by multiplying the parking expenses by the estimated percentage of the remaining unreserved spots used by employees.

Total parking expense

Less expense allocated to reserved employee spots

Less expense allocated to reserved nonemployee spots

Additional unrelated business taxable income

If an employer pays a third party so its employees may park at a third-party lot or garage, the disallowance is the employer’s total annual cost of employee parking paid to the third party, reduced by any amount that must be treated as compensation by the employee, which for the 2018 tax year is $260 per month under Internal Revenue Code Section 132(f)(2).

Contact Pargat Singh at psingh@cohenco.com or a member of your service team to discuss this topic further.

Cohen & Co is not rendering legal, accounting or other professional advice. Information contained in this post is considered accurate as of the date of publishing. Any action taken based on information in this blog should be taken only after a detailed review of the specific facts, circumstances and current law.